Sorry, nothing in cart.

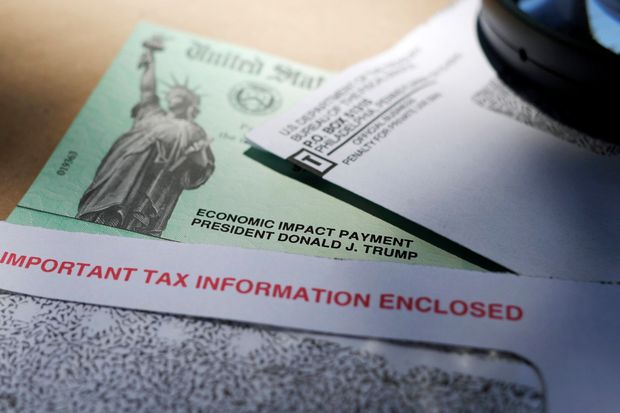

Second Stimulus Checks: When Will They Arrive, How Much Will They Be?

- By michael@cvcteam.com

- |

Congress is likely to vote soon to authorize a second round of stimulus payments to households. There are many similarities to the ones that were paid in the spring but also some important differences. Here is what we know about them, though things could change as Congress releases details of the legislation and the government implements the program.

When will the second stimulus payments arrive?

Treasury Secretary Steven Mnuchin said Monday the first batch of payments could go out at the beginning of next week. That is faster than in the spring, where it took about two weeks after the legislation was signed. The first batches may also be larger than in the spring. That is because the government now has more information about groups that got later payments in the first round, including those who typically don’t file tax returns and those who receive federal benefits. Those who receive paper checks or debit cards instead of direct deposits will have to wait slightly longer. The bill is written so the IRS makes the payments by Jan. 15, meaning that anyone eligible after that date would likely have to get the money as part of their 2020 tax return.

How much are the payments? This time, households will get $600 per adult and $600 per child, down from $1,200 and $500 in the first round. That means a single parent with two children will get $1,800 now after receiving $2,200 in the spring.

What are the income limits?

The payments start phasing out when individual adjusted gross income exceeds $75,000, when head-of-household income exceeds $112,500, and when income for married couples filing jointly exceeds $150,000. For individuals without children, the payments go to zero when income reaches $87,000; that is $174,000 for married couples. The numbers are generally based on 2019 income.

What if my income or family size has changed?

As with the first round, households that qualify for a larger benefit based on their 2020 income can claim the difference between what they received and what they should have received. They can do that on the 2020 tax return. The Internal Revenue Service typically starts allowing tax filing in late January and makes refund payments within a few weeks of receiving returns.

What if I get too much money? Is the payment taxable?

The payments aren’t taxable income. Think of them as an increase to the tax refund you would normally receive in early 2021 and an early payment of that. If you get too much money—which can happen if you qualified based on 2019 income and your 2020 income was too high to get paid—you don’t have to pay back the difference.

Are college students and adult dependents eligible?

No, only children younger than 17 are expected to be eligible.

What about people without Social Security numbers?

This is an important change from the first set of payments. People without Social Security numbers—often unauthorized immigrants—are still not eligible, but their presence in a married couple doesn’t make their entire household ineligible.

Such mixed-status households can get payments this time based on the number of eligible people in the household—in contrast to the spring round, when they couldn’t get any money. And this change is retroactive, so they can claim an amount for the first payment as part of their 2020 tax returns.

What about deceased people?

This bill is much clearer than the spring version about the eligibility of people who have died. Anyone who died before Jan. 1, 2020 is ineligible but those who died this year are eligible.

Will the government or my bank withhold part of my check to pay debts I may owe?

Unlike typical tax refunds, these payments won’t be subject to garnishment in most cases, including student debt and state debt. And lawmakers added language limiting garnishment by banks this time around. They did retain rules that allow payments to be seized for overdue child support.

Leave a Reply